Article

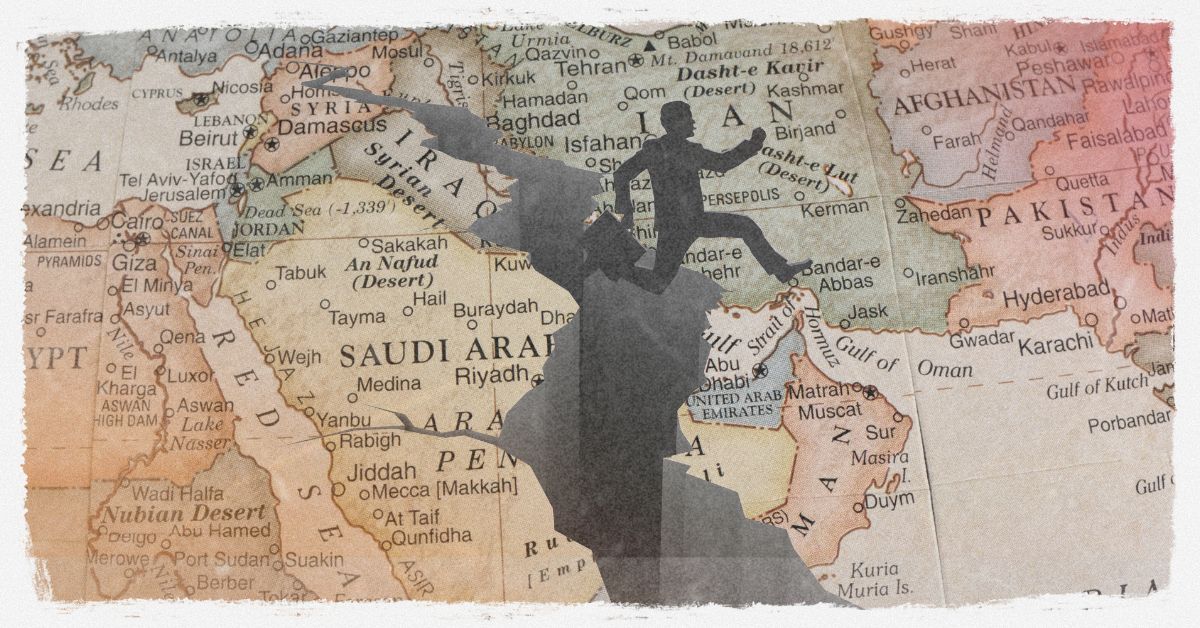

In an unprecedented confluence of geopolitical events, the international community has been thrust into heightened tension and speculation. The recent death of Iranian President Ebrahim Raisi, combined with the issuance of an arrest warrant for former Israeli Prime Minister Benjamin Netanyahu, has created a ripple effect through the global political landscape. This blog post aims to dissect these events, exploring their implications for Iran, regional stability, international relations, the economy, and private investors.

The Death of President Raisi: A Turning Point for Iran?

The sudden death of President Ebrahim Raisi marks a significant turning point for Iran. Raisi, a conservative cleric and former head of Iran’s judiciary, was a central figure in Iran’s political establishment. His presidency, though brief, was characterized by a continuation of hardline policies, particularly regarding Iran’s nuclear program and its stance towards the West.

Immediate Implications

- Power Vacuum and Political Uncertainty: Raisi’s death has left a power vacuum in Tehran. As Iran mourns, political factions within the government are vying for influence. This internal struggle could lead to a period of instability, impacting everything from domestic policy to international negotiations.

- Nuclear Negotiations: Iran’s nuclear program has been a contentious issue on the global stage. With Raisi’s death, the direction of these negotiations remains uncertain. The potential for a more moderate or an even more hardline successor could significantly alter the course of talks with the P5+1 countries.

- Regional Dynamics: Iran’s role in regional conflicts, such as those in Syria and Yemen, will likely be scrutinized closely. A change in leadership could lead to shifts in these engagements, affecting the broader Middle Eastern geopolitical landscape.

The Arrest Warrant for Benjamin Netanyahu: Legal and Political Ramifications

In another dramatic development, an international arrest warrant has been issued for former Israeli Prime Minister Benjamin Netanyahu. This move stems from ongoing corruption charges and accusations of abuse of power during his tenure.

Key Considerations

- Legal Proceedings and Political Fallout: Netanyahu’s legal battles have been ongoing for years, but an international arrest warrant issuance marks a significant escalation. This not only impacts Netanyahu personally but also raises questions about the integrity of Israeli political institutions and the rule of law.

- Impact on Israeli Politics: Netanyahu has been a dominant figure in Israeli politics for decades. His potential arrest could lead to a major reshuffling within the Likud party and the broader political spectrum. This instability could influence Israel’s domestic and foreign policy decisions.

- International Relations: Netanyahu’s tenure was marked by a strong stance against Iran and a close relationship with the United States, particularly under the Trump administration. Depending on how the situation evolves, his arrest could shift Israel’s diplomatic posture and open new avenues for dialogue or conflict.

Economic Ramifications For Private Investors

The geopolitical instability arising from these events will likely have significant economic implications. Investors must navigate these uncertainties carefully to protect their portfolios and capitalize on emerging opportunities.

Economic Impact

- Market Volatility: Geopolitical tensions typically lead to increased market volatility. Uncertainty in Iran and Israel could affect global markets, particularly in the energy, defence, and technology sectors. Investors may see fluctuations in stock prices, commodity prices, and currency exchange rates.

- Oil Prices: Iran is a major oil producer, and any instability in the country can influence global oil prices. Rising oil prices can lead to higher inflation, impacting consumer spending and economic growth worldwide. Conversely, if negotiations around Iran’s nuclear program lead to sanctions relief, oil supply could increase, stabilizing prices.

- Investor Sentiment: Political instability often leads to cautious investor sentiment. Risk-averse investors might pull back from equities and other volatile assets, opting for safer investments such as bonds or gold.

Investment Strategies

- Diversified Portfolio: The current geopolitical landscape underscores the importance of a diversified investment portfolio. By spreading investments across various asset classes, sectors, and geographic regions, investors can mitigate political and economic instability risks. Diversification helps protect against significant losses in any single investment.

- Alternative Assets: In times of uncertainty, alternative assets such as real estate, commodities, and private equity can offer stability and growth potential. These investments often have a low correlation with traditional asset classes, providing a hedge against market volatility. For instance, gold is widely seen as a haven during geopolitical crises.

- Monitoring and Flexibility: Investors should closely monitor geopolitical developments, especially in Iran, and be prepared to adjust their strategies accordingly. Staying informed and maintaining flexibility can help capitalize on emerging opportunities and avoid pitfalls.

The death of President Raisi and Benjamin Netanyahu’s arrest warrant represent significant junctures in Middle Eastern politics. As these situations develop, their impact will be felt not only in Iran and Israel but across the globe. For policymakers, analysts, and international observers, staying informed and adaptable will be key to navigating the uncertain future these events herald.

For private investors, the current geopolitical and economic instability highlights the need for a diversified portfolio and the consideration of alternative assets. Investors can mitigate risks and seize opportunities in this volatile environment by employing strategic investment approaches.

At De Pointe Research, we are committed to providing in-depth analysis and insights into these and other critical developments. Our team of experts continues to monitor the situation closely, offering timely updates and strategic perspectives to help our clients understand and respond to the evolving geopolitical landscape.

Subscribe to our blog for more detailed reports and analyses on these unfolding events.