Article

In recent months, the Labour Party has hinted at potentially reconsidering aspects of Brexit, although it has maintained an official stance of respecting the referendum result. This nuanced position could pave the way for a closer relationship with the EU, raising questions about what re-accession might look like, the hurdles involved, and the implications for investors.

Potential Re-accession to the EU: What It Could Look Like

If the UK were to pursue rejoining the EU, the process would be complex and multifaceted. Here’s an outline of what re-accession might entail:

- Formal Application: The UK would need to formally apply for membership, which would involve submitting a request to the European Council inviting the European Commission to assess the application.

- Acquis Communautaire: The UK would need to adopt the EU’s body of laws, the acquis communautaire. While many laws were retained post-Brexit, re-aligning with updated regulations would be necessary.

- Negotiations: Extensive negotiations would follow, covering various areas such as trade, immigration, fisheries, and financial contributions. The process could take several years and would require significant diplomatic efforts.

- Referendum or Parliamentary Approval: Given the political sensitivity, a new referendum or parliamentary approval might be necessary to legitimise the decision to rejoin.

- Transition Period: A transition period would likely be established to allow businesses and institutions to adapt to the new regulatory environment.

Hurdles to Re-accession

- Political Resistance: Domestically, re-accession could face substantial political resistance, especially from Brexit supporters and those who feel the 2016 referendum should be upheld.

- Economic Costs: The economic costs of rejoining, including potential budgetary contributions to the EU and compliance costs for businesses, could be significant.

- Regulatory Alignment: Re-aligning with EU regulations would require significant adjustments in many sectors, potentially disrupting businesses that have adapted to post-Brexit rules.

- Negotiation Challenges: Negotiating favourable terms for re-accession would be challenging. The EU may impose stricter conditions than those the UK previously enjoyed, such as opting out of specific policies.

- Public Opinion: Despite a rise in support for rejoining the EU, the UK public remains divided. Garnering sufficient support for re-accession would be crucial to avoid further political instability.

Public Opinion on Rejoining the EU

UK Public Opinion:

- A poll by YouGov in June 2023 showed that 54% of Britons would vote to rejoin the EU, while 32% would vote to stay out, indicating a significant shift in public sentiment since the 2016 referendum (Evening Standard).

- Another survey by the European Social Survey in late 2023 revealed that younger voters, particularly those aged 18-34, are overwhelmingly in favour of rejoining, while older demographics remain more sceptical (Evening Standard).

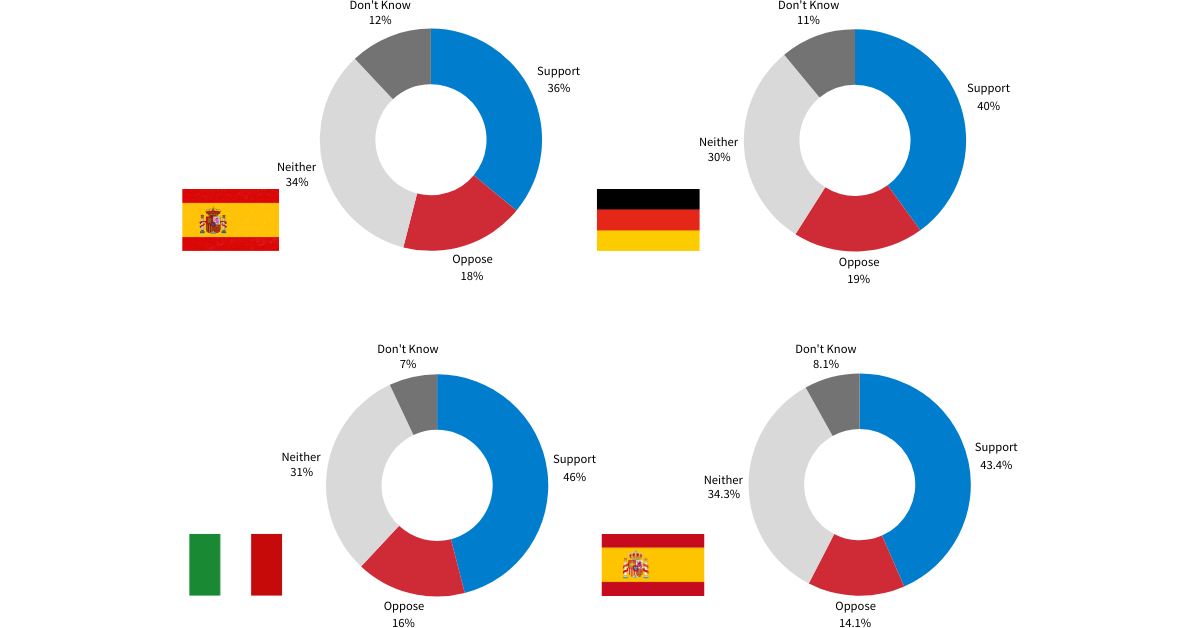

EU Member States’ Opinions:

- France and Germany: Key EU members like France and Germany have shown cautious openness to the idea of the UK rejoining but emphasise that any re-accession would require the UK to comply with EU laws and regulations fully.

- Eastern European States: Countries like Poland and Hungary might support the UK’s re-entry, viewing it as a counterbalance to Franco-German dominance within the EU.

- Southern Europe: Nations such as Spain and Italy are likely to support re-accession, provided it strengthens the EU economically and politically.

Question: Would you support or oppose the UK re-joining the EU?

Implications for Investors

Positive Impacts

- Market Stability: Rejoining the EU could stabilise market expectations, reduce currency volatility, and provide a more predictable business environment.

- Growth Opportunities: Investors could benefit from renewed access to the single market, leading to diversified investment opportunities and potentially higher returns.

- Regulatory Certainty: Harmonizing UK regulations with the EU would simplify cross-border investments, making it easier for businesses to operate across Europe.

Risks and Uncertainties

- Transition Costs: The process of rejoining the EU would involve substantial economic and administrative costs, impacting short-term economic performance.

- Political Instability: Moves to rejoin the EU could trigger political instability, especially if significant portions of the population and political landscape remain divided on the issue.

- Regulatory Changes: Investors would need to navigate the changing regulatory landscape, which could entail compliance costs and operational adjustments.

Labour’s hints at a softer stance towards the EU suggest a potential shift in the UK’s relationship with Europe. While the prospect of rejoining the EU presents numerous opportunities for market stability and growth, it also poses significant challenges and uncertainties. Investors should monitor political developments closely, consider the economic implications, and prepare for potential regulatory changes. Engaging with financial advisors and staying informed about public opinion and EU member states’ positions will be crucial in navigating this evolving landscape.