Article

After Sir Keir Starmer’s warning of a “painful” Autumn Budget, speculation has been frenzied, with investors, pundits and businesses concerned they will be the ones to bear the brunt of the pain. This caution from the Labour leader comes after the revelation that the Labour Party inherited a £22 billion overspend without the means to cover the expenditure.

One would be remiss to understate the precarious state of the UK economy, with Government debt at an all-time high of £2.7 trillion, the government’s commitment to a 5.5% pay rise for NHS staff, teachers and members of the armed forces, a commitment projected to cost an extra £10 billion, and increasing pressure from various unions for further pay rises in different sectors, there is undoubtedly a large hole to fill in the country’s coffers. But the question remains… Where will it come from?

Let us start with what we can rule out, namely income tax, national insurance for employees, and value-added tax (VAT). Starmer and other senior politicians pledged to this at the 2023 Labour Conference and throughout the General Election campaign. This leaves the brunt likely to fall on a handful of remaining taxes, most of which are likely to significantly impact middle-class investors.

Employer National Insurance Contributions

Increasing Employer National Insurance contributions is an easier, more palatable path for Labour. This allows the government to raise tax revenue from wages without directly impacting voters’ incomes. This is also in line with the Party’s pledge not to raise taxes for workers. While this would not impact employees, it would have a destructive effect on the thousands of small businesses nationwide.

Capital Gains Tax (CGT)

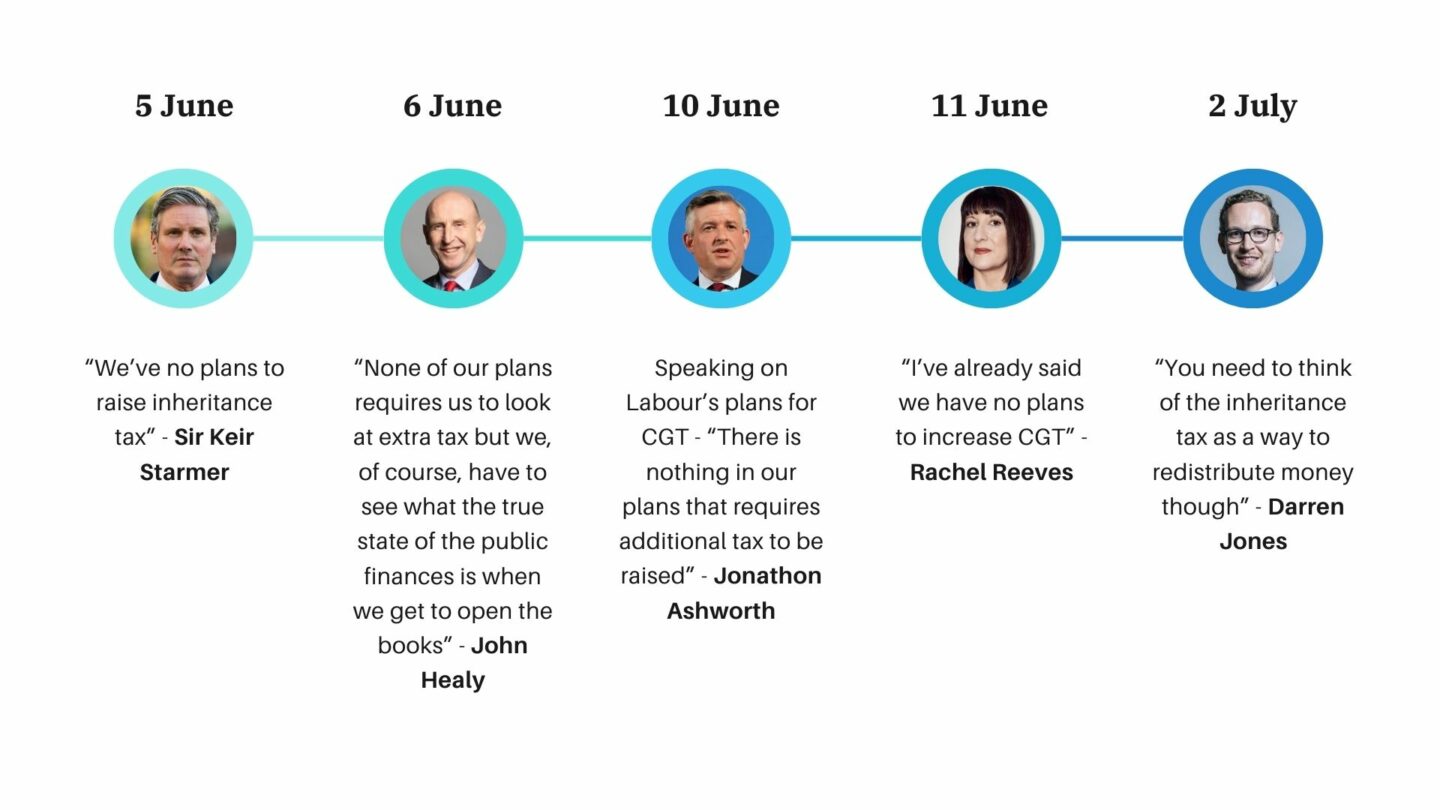

There has been a great deal of speculation that the Labour Party will bring capital gains in line with income, i.e. high earners could pay as much as 40% on the profits from their investments. Several senior Labour MPs initially ruled out increases to this tax, but the fate of CGT has been up in the air recently.

Mixed messaging from senior Labour MPs leaves us none the wiser as to plans for the Autumn Budget

Inheritance Tax (IHT)

Arguably one of the most contentious taxes, Inheritance Tax is often argued to be a double tax and the current rate in the UK is among the five highest Inheritance Tax Rates in the OECP. In spite of this, reforms to Inheritance Tax are currently under discussion as senior MPs in the Labour Party debate that IHT allows generational wealth to be redistributed.

Pensions

Many speculate that Pensions could be a victim of reforms in the Autumn Budget; Labour’s focus on wealth inequality means that Pensions Tax Relief, often argued to benefit the affluent disproportionately, could be a prime target in Labour’s open season on the wealthy. This could take the form of reducing the annual allowance or reintroducing the lifetime allowance.

Business Relief

There has already been discussion about reforms to the Business Relief, a policy offering investors 50% to 100% Inheritance Tax Relief on Business Assets; concerns were raised earlier this year when Rachel Reeves was urged to abolish the Inheritance Tax Relief that investors benefit from when investing into some AIM shares, with experts warning that this could cause a major selloff in the market, a topic we covered here.

While we can’t know for sure what the Autumn Budget holds, we can know for sure that it will likely be painful for many investors across the country. Fortunately, there are solutions to make the Autumn budget more palatable, such as subscribing to De Pointe Research to keep abreast of the latest in the investing, economic, and financial world.