Article

As speculation grows around the potential ascendancy of Keir Starmer to Prime Minister, the UK’s financial landscape is poised for significant shifts. Wealthy investors and corporations are recalibrating their strategies in light of anticipated changes in tax policies and regulatory environments. This article explores how the affluent are positioning their portfolios to mitigate risks and capitalise on opportunities under a Labour government.

This is also leading to an unsettling trend: a forecasted exodus of approximately 9,500 HNWIs from the UK in 2024. The uncertainty and potential financial disadvantages are driving the wealthy to look for greener pastures.

Interactive graph

Sector-Specific Impacts

Under a Labour government, several sectors are likely to experience direct and indirect impacts:

- Energy Sector: The proposal for a windfall tax on excess energy profits could dampen profitability for fossil fuel giants, influencing their operational and strategic decisions. This, in turn, would affect industries reliant on energy, such as travel, hospitality, and logistics, raising operational costs and squeezing margins.

- Food, Alcohol, and Tobacco: Labour’s public health initiatives might target these industries with higher taxes and regulations, aiming to reduce the consumption of unhealthy products through fiscal disincentives, much like the sugar tax.

- Real Estate and Construction: Property developers might find a silver lining as Labour seeks to address the housing shortage through incentives for developing brownfield sites into residential properties.

- Sustainability and Clean Energy: Businesses in recycling, clean energy, and electric vehicles may benefit from supportive policies as Labour prioritises environmental sustainability.

- Niche Sectors: Any businesses that are operating profitably but that are unlikely to appear on the government’s radar will most probably avoid any major impact directly from a labour government while they may still be hit by a knock-on effect. These might include data, analytics or research companies.

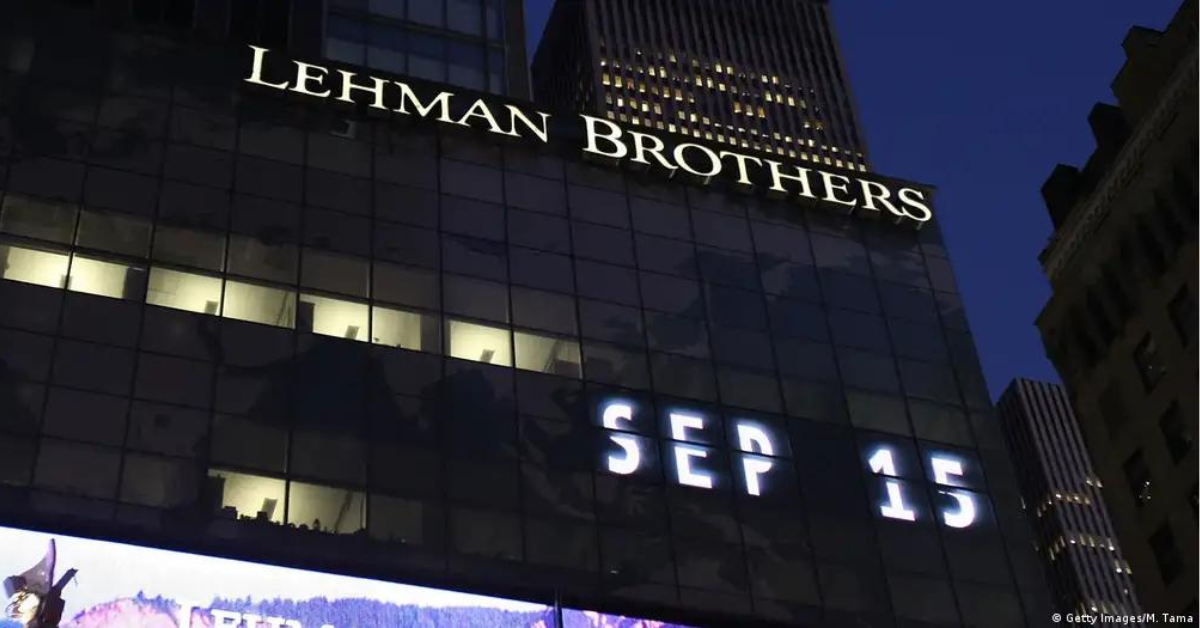

As a whole, the stock market tends to prefer a Tory government, and while the markets are never stable, investors can expect a greater degree of volatility than usual. Many wealthy investors utilise real assets as a means to hedge against stock market volatility. Art investments, for example, are known for their robust nature and ability to cruise calmly amidst stock market turbulence. Art was described in this Forbes article as having “remarkable resilience” and has shown time and time again that it can serve as a stalwart in an investor’s portfolio. In fact, this is no better exemplified than in 2008 when, on the very same day that Lehman Brothers collapsed, Damien Hirst’s Auction set new records for the most expensive single artist auction ever. Investors worried about the volatility of the stock market should follow this link to read more about the resilience of the Art Market here.

Image: Getty Images/M. Tama

While art can allow investors to hedge against stock market volatility, for those more concerned about the rise in capital gains, Gold offers a tremendous degree of tax efficiency. All gold is VAT exempt, and gold coins that are considered UK currency, such as Britannia and Sovereigns, are exempt from the capital gains tax, which naturally prompts a significant exodus to buy gold. If you are likely to be affected by a change to CGT legislation, you can discover more about the CGT exemption and other benefits of Gold here.

Changes to Inheritance Tax are also on the radar, with potential reforms making it costlier to pass on wealth. These changes could see families paying out hundreds of thousands in taxes after losing a loved one. Certain property investments can offer people an investment. Certain investments aimed at funding property development can provide investors with Inheritance Tax Exemption by means of business rate relief. Discover more opportunities in the property market here.

While the anticipation of a Keir Starmer-led government brings with it a degree of uncertainty and potential financial upheaval, it also opens doors for strategic investment and wealth preservation. By understanding the likely policy shifts and aligning their portfolios accordingly, investors can navigate these changes effectively, securing their financial future in a transforming political landscape.