Article

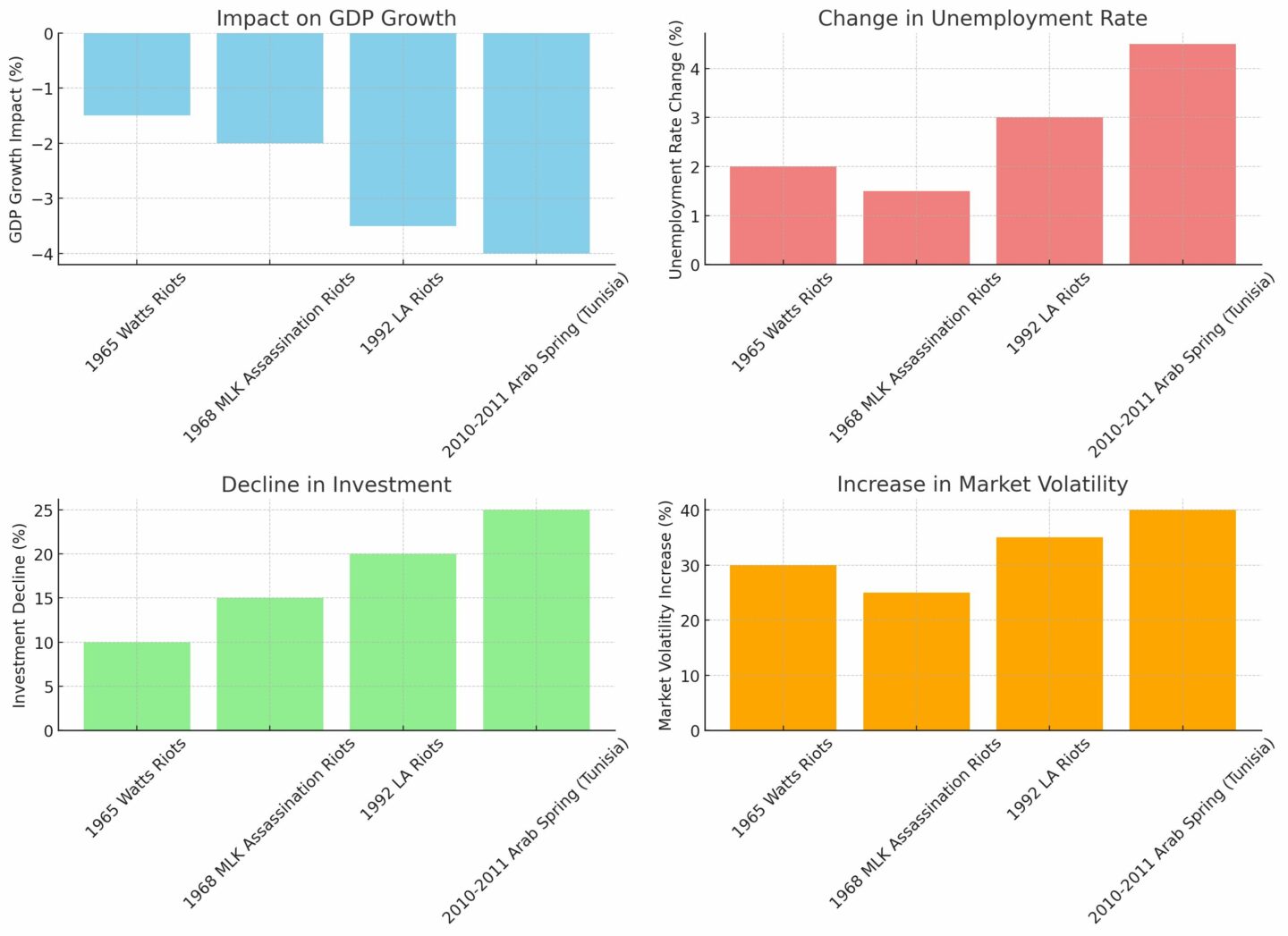

Riots are disruptive events that can have far-reaching consequences beyond immediate physical damage and social unrest. One of the less discussed yet profoundly significant impacts of riots is their effect on investor confidence, financial markets, and the broader economy. Understanding these impacts is crucial for policymakers, investors, and businesses as they navigate the aftermath of such turbulent events. This article explores the intricate relationship between riots and economic stability, providing an in-depth analysis based on historical data and research.

The Immediate Impact on Investor Confidence

Investor confidence is a critical determinant of market behaviour and economic health. When riots occur, they often create an atmosphere of uncertainty and fear. Historical data shows that this immediate reaction can lead to several negative outcomes:

1. Withdrawal of Investments: Investors tend to pull out their funds from regions experiencing unrest, fearing instability and potential losses. This withdrawal can lead to a sudden drop in stock prices and capital flight.

2. Increased Risk Perception: Riots heighten the perceived risk associated with investing in affected areas. Higher risk perception typically translates to higher required returns on investments, making it more expensive for businesses to raise capital.

3. Flight to Safety: In times of unrest, investors often move their capital to safer assets, such as government bonds or stable foreign markets. This shift can depress the stock markets in the affected region while inflating bond prices and reducing yields.

Case Study: The 1992 Los Angeles Riots

The 1992 Los Angeles riots serve as a poignant example. Following the acquittal of police officers involved in the beating of Rodney King, the city erupted in violence. The immediate impact on investor confidence was stark. The Los Angeles Stock Exchange saw a significant drop in trading volume, and local businesses experienced a sharp decline in investment. The real estate market also suffered as property values plummeted in the riot-affected areas.

Market Reactions and Economic Consequences

Riots can have both short-term and long-term effects on financial markets and the broader economy. The extent of these effects largely depends on the scale and duration of the unrest.

Short-term Market Reactions

1. Stock Market Volatility: Riots often lead to increased volatility in stock markets. The uncertainty surrounding the duration and intensity of the unrest can cause sharp fluctuations in stock prices.

2. Sector-specific Impacts: Certain sectors may be more affected than others. For instance, the retail and hospitality sectors often bear the brunt due to physical damage and reduced consumer footfall. Conversely, security and reconstruction firms might see a temporary boost.

3. Currency Depreciation: Countries experiencing significant riots might see their currency depreciate due to a loss of investor confidence and the resultant capital outflows.

Long-term Economic Consequences

1. Reduced Economic Growth: Prolonged unrest can lead to sustained economic downturns. Businesses may shut down or relocate, leading to job losses and reduced economic activity. The rebuilding process can be slow and costly, further hampering growth.

2. Deterioration of Public Services: Riots often damage infrastructure, necessitating substantial public expenditure for repairs and reconstruction. This diversion of funds can lead to a deterioration in other public services, affecting long-term economic stability.

3. Social Costs: Riots can have long-lasting social impacts beyond the immediate economic costs. Increased insurance premiums, higher security costs, and the psychological impact on residents can lead to a more risk-averse and less dynamic economy.

Case Study: The Arab Spring

Riots are typically associated with negative economic consequences, but in some rare cases, they can lead to positive economic changes, albeit often indirectly and in the long term. These positive impacts usually arise from significant social and political reforms that follow the unrest. Here, we discuss a few case studies where riots and social upheaval have indirectly contributed to economic benefits.

The Arab Spring, which began in late 2010, was a series of anti-government protests, uprisings, and armed rebellions across the Arab world. Tunisia was the birthplace of this movement, with widespread protests leading to the ousting of President Zine El Abidine Ben Ali in January 2011.

Positive Economic Impacts

1. Political Reforms: The protests led to significant political reforms, including the drafting of a new constitution, free elections, and the establishment of a more democratic government. These political changes helped to stabilise the country and attract international support and investment.

2. Foreign Aid and Investment: The international community, including the European Union and the World Bank, provided substantial financial aid and support to Tunisia. This aid was aimed at stabilising the economy, promoting democratic governance, and fostering economic development.

3. Economic Diversification: The new government focused on diversifying the economy, reducing reliance on traditional sectors like agriculture and tourism, and encouraging growth in technology and service industries. This diversification helped to create new jobs and stimulate economic growth.

Long-term Benefits

While Tunisia has faced ongoing challenges, including economic instability and social unrest, the initial reforms and international support laid the groundwork for a more resilient economy. The move towards a more open and democratic society has potential long-term economic benefits, including increased foreign investment and improved governance.

Mitigating the Impact of Riots

Understanding the financial impact of riots is the first step towards mitigation. Policymakers and businesses can take several steps to reduce the negative economic consequences:

1. Strengthening Institutions: Robust legal and political institutions can help mitigate the impact of riots by ensuring quick and fair resolution of underlying issues.

2. Economic Diversification: Economies that are less reliant on a single industry or sector can better withstand the economic shocks caused by riots.

3. Enhanced Security Measures: Improving security infrastructure and response mechanisms can help contain the physical damage and restore investor confidence more rapidly.

4. Community Engagement: Engaging with communities to address grievances and prevent riots from occurring in the first place is a crucial preventive measure.

Riots undeniably have a significant impact on investor confidence, financial markets, and the broader economy. The immediate withdrawal of investments, increased market volatility, and long-term economic downturns underscore the need for comprehensive strategies to mitigate these effects. By learning from historical events and implementing robust policies, stakeholders can better navigate the economic challenges posed by riots and work towards a more resilient economic future.

Understanding the financial impact of riots is not just about analysing numbers; it’s about recognising the broader socio-economic dynamics at play and working collaboratively towards sustainable solutions.