Article

At De Pointe Research, we spend most of our time identifying opportunities—finding markets, assets, and vehicles that generate outsized returns and preserve wealth in times of turbulence. But prudent investing isn’t just about where to place capital—it’s also about where not to invest. As we move deeper into 2025, the global investment landscape is riddled with geopolitical tensions, shifting consumer behaviours, and systemic slowdowns across traditional sectors. While many alternative investments continue to thrive, several familiar sectors are flashing red.

Here’s a data-led review of the seven markets investors should approach with extreme caution right now.

1. U.S. Equities Amid Trade Volatility and AI Overhype

U.S. stock markets have long been considered the bedrock of global investing. But even the most robust markets face correction—and right now, American equities are wobbling under political and economic strain. Citi recently downgraded U.S. equities from Overweight to Neutral, highlighting a mismatch between tech sector hype and real earnings growth.

The tech-heavy S&P 500 has been rocked by disillusionment with AI: while investor excitement surged through 2023–24, earnings from top firms like Nvidia and Google have not met aggressive projections. Add to this the uncertainty created by renewed trade tariffs—particularly under Donald Trump’s potential second-term economic policies—and you have a marketplace where investor sentiment is easily rattled.

For global investors, this means potential overexposure to an increasingly unpredictable market. Diversification toward more stable or undervalued international markets (e.g., Japan or the UK) may prove more fruitful in the near term.

2. The Oil and Gas Sector: Declining Demand Meets Rising Costs

Once a reliable income-generating sector, oil and gas face a two-pronged assault: structural decline and political interference.

On the one hand, demand for fossil fuels is tapering as green energy transitions accelerate. Conversely, U.S. energy firms are contending with rising operational costs driven by new tariffs, especially on imported steel used in drilling rigs and pipelines. WTI crude prices have fallen 15% since early April, signalling bearish sentiment even as global consumption remains high.

Further risk arises from the political sphere. Energy companies are preparing for regulatory whiplash depending on the outcome of the U.S. presidential election. Investors should know that fossil fuel profitability is likely more influenced by policy than performance.

3. Traditional Retail: A Sector Still in Freefall

The demise of traditional retail is hardly a surprise, but the sector continues to deliver downside risk.

While the pandemic accelerated e-commerce adoption, many investors believed there would be a rebound in physical retail footfall post-COVID. This rebound never materialised. Major high-street names continue to shutter locations, and the labour market is shifting accordingly—retail employees are retraining for logistics, warehousing, and digital support roles.

Investors should remain wary of portfolios exposed to outdated retail REITs or consumer brands overly reliant on in-store experiences. Without significant digital transformation, these businesses remain on shaky ground.

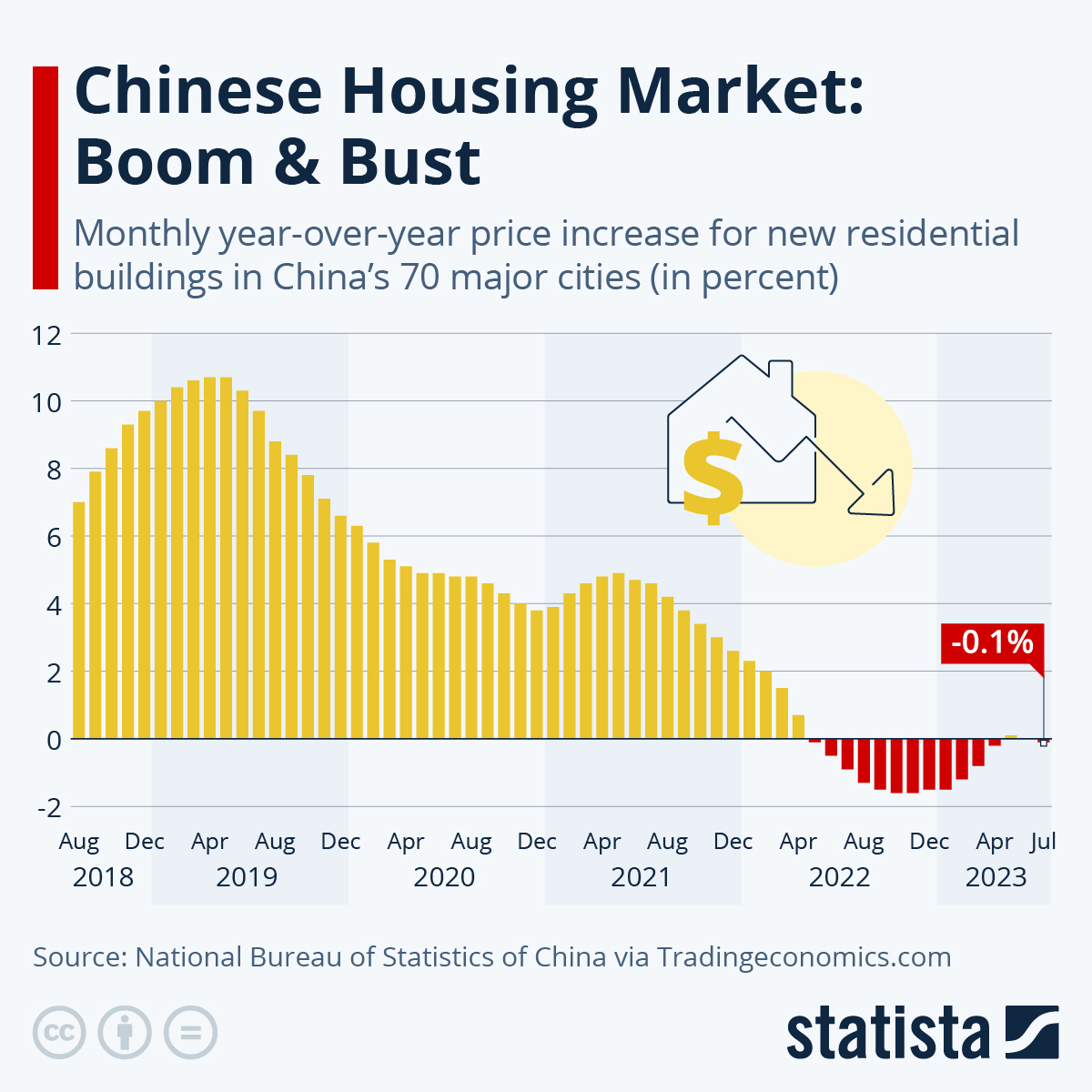

4. China’s Property Market: Still in Crisis Mode

China’s property sector, long considered the engine of its economic miracle, is undergoing an extended meltdown. The collapse of Evergrande in 2021 signalled the start of a debt-fuelled crisis, and the problems have only deepened. Even as the Chinese government injects stimulus and eases purchasing restrictions, confidence has not returned.

Major developers, including Vanke and Country Garden, struggle to meet debt obligations. Property prices continue to decline across Tier 2 and Tier 3 cities, dragging down consumer sentiment and regional GDP contributions.

Global investors exposed to Chinese real estate—whether through direct holdings or emerging market funds—should conduct a risk audit immediately. A recovery may happen, but few analysts see one before 2026.

You will find more infographics at Statista

You will find more infographics at Statista5. Video Games: A Booming Industry… in Retreat

Ironically, while gaming is more popular than ever, the industry’s economics are currently flawed. Development costs have soared, particularly for AAA titles, with blockbuster games now requiring hundreds of teams and budgets in the hundreds of millions. Many firms have overextended.

This has led to waves of layoffs at companies like Epic Games, Ubisoft, and Microsoft and the cancellation of dozens of major releases. Venture capital funding for indie studios has also slowed as margins tighten and competition from subscription models increases.

The industry’s long-term outlook remains positive, especially with virtual and augmented reality integration. But until cost structures normalise, investor capital should be parked elsewhere.

6. High-Yield Bonds: Junk Debt, Elevated Risk

High-yield bonds, often dubbed “junk bonds,” are typically attractive to income-focused investors due to their above-average returns. However, in the current macroeconomic climate, these instruments are particularly exposed.

Potential interest rate shifts, especially if inflation resurges, could reprice corporate debt downward. With uncertainty looming over GDP growth in the U.S. and Europe, risk premiums may spike, further devaluing these bonds.

Investors seeking yield should explore alternative credit strategies or fixed-income opportunities tied to asset-backed securities, where underlying collateral (such as gold or infrastructure) provides tangible downside protection.

7. Manufacturing: Squeezed from All Sides

The global manufacturing industry is being pinched by cost inflation, disrupted supply chains, and weak demand from developed and emerging markets alike. This is particularly evident in sectors like automotive, aerospace, and industrial machinery, where orders have declined and profit margins are thinning.

A recent Deloitte report highlighted that while automation and AI present long-term benefits, the short-term adjustment period will be painful. Companies are being forced to restructure operations while also investing heavily in digitisation—a costly and uncertain balancing act.

As an investment, the sector currently lacks the stability or excitement that more future-proof areas like renewable energy, AI infrastructure, or health tech can offer.

In volatile times, discipline and foresight win. While it’s tempting to chase the next tech boom or snap up blue-chip stocks on a dip, it’s equally important to know when to step aside and where not to invest. The sectors outlined above are not guaranteed losers, but they do represent disproportionately high risk compared to current opportunities in alternative assets, tangible collectables, and niche international markets.

At De Pointe Research, we advocate a well-diversified portfolio with exposure to uncorrelated assets that can weather macroeconomic storms—particularly those like art, gold, and exclusive collectables, which have demonstrated resilience even when traditional markets falter.

Now is the time to protect, preserve, and position—not to speculate on the edge of collapse.