Article

The announcement of Ted Baker’s decision to close all its UK and Irish stores has sent ripples through the retail sector. As one of Britain’s most iconic fashion brands, Ted Baker’s retreat from brick-and-mortar retail raises serious questions about the future of the high street and the broader implications for the UK economy.

Ted Baker’s Legacy and Struggles

Founded in 1988, Ted Baker quickly established itself as a go-to brand for stylish, high-quality clothing. The brand’s quirky yet sophisticated designs resonated with a broad audience, allowing it to expand rapidly in the UK and internationally. However, in recent years, Ted Baker has faced significant challenges. Leadership issues, declining sales, and the changing landscape of retail have all contributed to its current predicament.

The COVID-19 pandemic accelerated these challenges. Store closures during lockdowns and a sharp decline in consumer spending hit Ted Baker hard. Even as the pandemic’s immediate effects have waned, the brand has struggled to recover fully. The decision to close all UK and Irish stores is a stark indication of these ongoing difficulties.

The UK Retail Sector: A Sector in Decline?

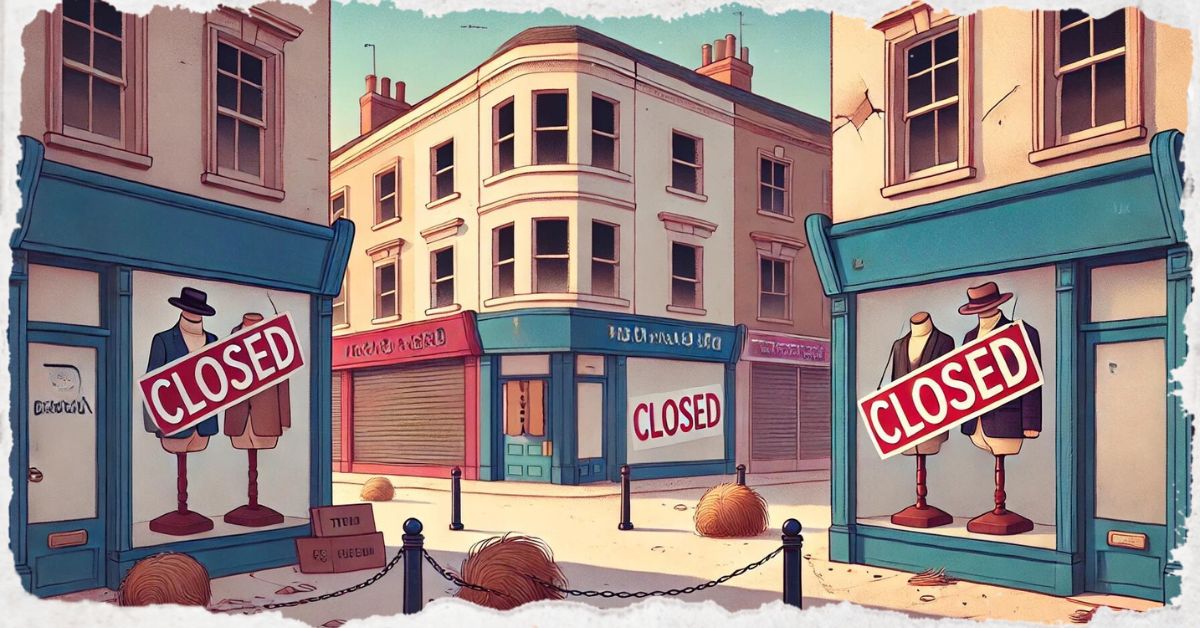

Ted Baker’s closures are symptomatic of a broader trend in the UK retail sector. Over the past decade, the high street has been under significant pressure. The rise of e-commerce, changing consumer habits, and economic uncertainty have all taken their toll on physical retail stores.

In 2008, during the global financial crisis, the UK retail sector experienced a similar period of upheaval. Many high-street brands struggled to survive as consumer confidence plummeted. While some, like Ted Baker, managed to weather the storm, others were not so fortunate. The aftermath of the 2008 crisis saw a wave of store closures and bankruptcies, and the retail landscape was irrevocably changed.

Fast forward to today, and the situation is eerily similar. The combination of the COVID-19 pandemic, Brexit, and the cost-of-living crisis has created a perfect storm for the retail sector. Footfall on the high street has decreased dramatically, and many consumers have shifted to online shopping permanently. The once-vibrant high street is now peppered with vacant storefronts, and Ted Baker’s exit only adds to the gloom.

Economic Ramifications: More Than Just Retail

The closure of Ted Baker’s UK and Irish stores is not just a retail issue; it has broader economic implications. Retail is one of the largest employers in the UK, and store closures inevitably lead to job losses. With Ted Baker exiting the high street, hundreds of jobs are at risk, further exacerbating the economic challenges faced by the country.

Moreover, the health of the retail sector is often seen as a barometer of the overall economy. When consumers are confident, they spend more, and the retail industry thrives. Conversely, retail is one of the first sectors to feel the impact when the economy is struggling. Therefore, Ted Baker’s closures may indicate deeper economic troubles ahead.

A Harbinger of the End of the High Street?

The question on many minds is whether Ted Baker’s decision is a harbinger of the end of the high street. While it may be premature to sound the death knell for brick-and-mortar retail, there is no denying that the sector is in flux. The traditional high street, as we have known it for decades, is unlikely to return.

However, this does not mean that physical retail is dead. Instead, we may see a transformation of the high street, focusing more on experiences rather than just shopping. Retailers who can adapt to this new landscape, offering a blend of online and offline experiences, are likely to be the ones who survive and thrive.

The closure of Ted Baker’s UK stores is a stark reminder of the retail sector’s broader challenges, particularly for traditional brick-and-mortar businesses. Investors should be cautious, as this move reflects not just the struggles of a single brand but a broader shift towards e-commerce and changing consumer behaviours. The decline of physical retail space could lead to decreased valuations for retail properties and a potential sell-off in retail stocks, especially those heavily reliant on in-store sales.

For investors, this signals the importance of reassessing portfolios with significant exposure to traditional retail. It may be wise to shift focus towards companies that have successfully adapted to the digital landscape or those offering strong omnichannel strategies. While the immediate impact may be harmful, there could be long-term opportunities to invest in brands that are effectively navigating this retail transformation.

UK Retail Business Closures by Year

Economic Ramifications: More Than Just Retail

The closure of Ted Baker’s UK and Irish stores is not just a retail issue; it has broader economic implications. Retail is one of the largest employers in the UK, and store closures inevitably lead to job losses. With Ted Baker exiting the high street, hundreds of jobs are at risk, further exacerbating the economic challenges faced by the country.

Moreover, the health of the retail sector is often seen as a barometer of the overall economy. When consumers are confident, they spend more, and the retail industry thrives. Conversely, retail is one of the first sectors to feel the impact when the economy is struggling. Therefore, Ted Baker’s closures may indicate deeper economic troubles ahead.

A Harbinger of the End of the High Street?

The question on many minds is whether Ted Baker’s decision is a harbinger of the end of the high street. While it may be premature to sound the death knell for brick-and-mortar retail, there is no denying that the sector is in flux. The traditional high street, as we have known it for decades, is unlikely to return.

However, this does not mean that physical retail is dead. Instead, we may see a transformation of the high street, focusing more on experiences rather than just shopping. Retailers who can adapt to this new landscape, offering a blend of online and offline experiences, are likely to be the ones who survive and thrive.

The closure of Ted Baker’s UK stores is a stark reminder of the retail sector’s broader challenges, particularly for traditional brick-and-mortar businesses. Investors should be cautious, as this move reflects not just the struggles of a single brand but a broader shift towards e-commerce and changing consumer behaviours. The decline of physical retail space could lead to decreased valuations for retail properties and a potential sell-off in retail stocks, especially those heavily reliant on in-store sales.

For investors, this signals the importance of reassessing portfolios with significant exposure to traditional retail. It may be wise to shift focus towards companies that have successfully adapted to the digital landscape or those offering strong omnichannel strategies. While the immediate impact may be harmful, there could be long-term opportunities to invest in brands that are effectively navigating this retail transformation.